Understand all aspects of the global economy to make better financial decision in our Quarterly Market Analysis update. Every quarter, we will post our Quarterly Market Analysis for you which consists of everything you need to understand circulating the global economic situation, projections, and analysis by our CEO and Independent Financial Advisor, Dominic James Murray.

It’s Been Brutal Out There

There has been no hiding in 2022. It has officially been the worst first half of a year for equity markets since 1970 (Forbes). As such, global equity portfolios have suffered significantly over the first six months of 2022. It has not been pretty, and it will have not been very much fun for those of you who can’t resist from checking their online portfolios on a daily basis. The cardinal sin of investing.

Panic Stations At The Ready?

Not at all. Quite the opposite. The historical data has shown us time and time again, that periods of volatility, are closely followed by strong upswings in the market. Making knee-jerk portfolio changes during periods of volatility is akin to portfolio suicide. As it is effectively leaving the equity markets during a low period, waiting for positive market sentiment to return, and then trying to buy back into the market after is already bounced up by 10 to 20%. Effectively, selling low and buy high, and in doing so, missing out on the largest growth days in the markets.

This phenomenon is not new and is a natural trait of retail investors as their emotions get the better of them. However, it is what can cause serious long-term harm to your portfolio. During periods of volatility, the biggest losers, are those who sell their portfolios. The biggest winners, are those who hold their portfolio, or look to buy more equities with any disposable capital while the markets are going through a possible low point.

The above has been proven during every period of volatility we have had over the past few decades (2001, 2008, 2015, 2020). This is not always easy as an investor. It goes against their emotional behaviour, of wanting to ‘limit their losses’ or ‘stop the rot’. And this is the number one reason why retail investors should not manage their own money, as it is almost impossible to remove that emotional bias and maintain a rationale outlook.

Time In The Market Vs Trying To Time The Markets

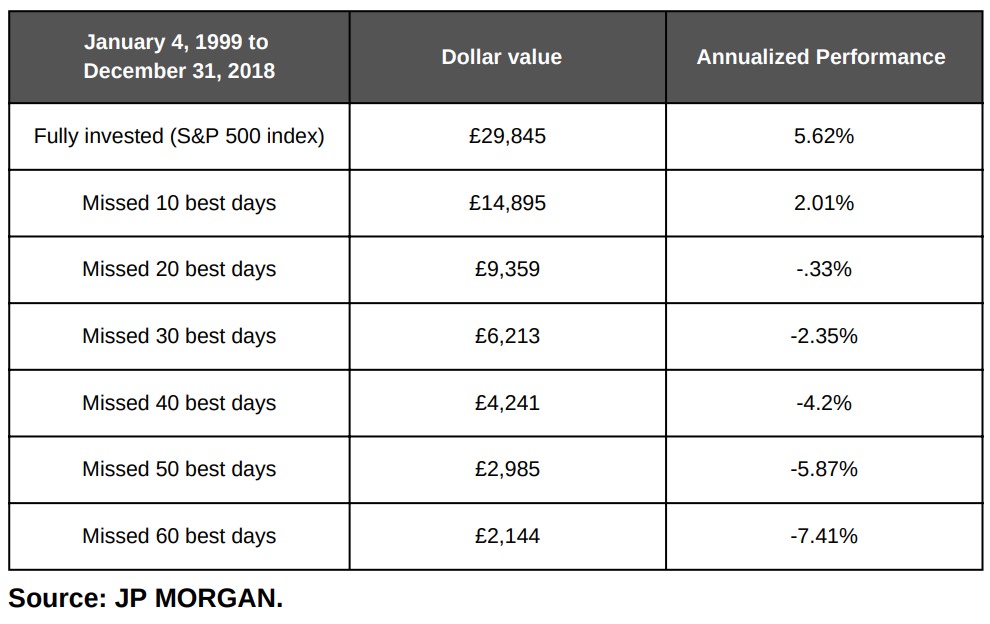

In 2019, J.P. Morgan Asset Management actually completed an analysis of how pulling out of the market affects your long-term portfolio returns. They found that, over the 20-year period from January 1999 to December 2018, if you missed the top 10 best days in the stock market, your overall return was cut in half. Yes, that is a 50% difference for only missing 10 days over a two decade period.

Evidenced below with the example of how a £10,000 investment would have fared over the past 20 years depending on if its investor stayed invested or, instead, missed some of the market’s best days.

As outlined above, you don’t have to miss many good days to feel the impact. The return went from positive to negative by missing the 20 best days of the market over 20 years. Putnam Investments found similar results by studying the data from 2003 to 2018. If you were fully invested in the S&P 500, your annualized total return was 7.7% during that time. But if you missed the 10 best days in the market, it dropped to a paltry 2.65%.

Stay Calm & Keep Investing

We have been pleased to see, an increasing number of clients get in touch, asking if now is a ‘good time to invest’ additional funds in the equity markets. While we are not advocates of trying to ‘time the markets’, periods of volatility, can provide excellent entry points into the equity markets. As such, this is the correct mindset to have. Seeing periods of volatility as opportunities to buy equities at a possible discount and improve your long-term portfolio wealth. It is similar to going to John Lewis during the January sales.

Did We Play Into Putin’s Hands?

The Ukraine war still remains a looming influence over world economics.

According to a BBC News article, Russia has earned a total of $97 billion dollars on energy exports since the start of the invasion. So, have the sanctions worked or was Putin one step ahead, with simple economics that sanctions will limit supply and thus increase prices, meaning they need to do half as much work and yet earn more than before they invaded Ukraine?

Demanding payment in Roubles, was also extremely smart, and has seen the Russian currency reach unprecedented highs against global currencies. As countries like Germany struggle to wean themselves off the supply of oil and gas in London. I was in Mayfair last week speaking with some oil and energy traders, and they said times had never been so good. The volatility and spreads on oil and gas are making for rich pickings for Russia. Not so good news for the regular household!

Despite worldwide sanctions of Russia and its exports, oil and gas remains a sticking point, Europe in particular is still in reliance making up 61% of import. However, we have seen a trend of these oil and gas exports falling overall. Some world leaders argue cuts in Russia’s energy exports are not happening fast enough and are allowing Russia to continue funding its war against Ukraine. The EU has plans to ban Russian oil arriving by Sea by the end of 2022, which would cut its own imports of Russian oil by 2/3rds.

Even considering the bans, other loopholes have opened, with gas and oil being sold onto Europe and the US by third parties such as India. It was detailed that India has increased its crude oil imports by approximately 17% since the beginning of the evasion.

Why Has Q2 Been Another Bad Quarter?

As suspected at the end of Q1 2022, without a clear end to the Ukraine war, the global economic recovery has slowed and triggered a cost of living crisis. Countries worldwide are dealing with higher commodity prices, particularly energy imports, increasing the cost of living, reducing people’s disposable income, and dampening the recovery.

A clear concern now is stagflation, due to the high inflationary conditions that are in part a result of the war. Stagflation is the unusual circumstance where high inflation is combined with high unemployment and low demand in a country’s economy. Typically, inflation will be lower during periods of recession as the demand in an economy is low. However, the inflationary pressures are actually a supply side issue. This then becomes a difficult situation to tackle with government tools, as monetary policy and the use of interest rates, have opposing effects on demand and inflation, depending on whether you increase or decrease rates. Governments will often use or complement traditional tools with alternative policies such as price controls or wage limits, France has imposed a price cap of up to 4 percent on bills in 2022.

Long-term strategies could be to divert away from the use of oil, as our dependence on it, is the main driver of the resulting inflation. This is eerily similar to the period of the 1970s when we saw stagflation as a result of high oil prices caused by a shortage of supply, following these countries were forced to make significant interest rate hikes which triggered a series of financial crises, especially in emerging markets and developing countries.

However, they are defining differences from that period, since then, monetary policy has come leaps and bounds and central banks now have a clear strategy in place to deal with these economic conditions. As a consequence, public panic can be dampened, avoiding an exacerbation of inflationary pressures and swift action can help stop prices from getting out of control. Additionally, the dollar is currently strong compared to its weakness in the 1970s.

CETV Values Decreasing In 2022

In one of our latest YouTube videos, we discuss how CETV values have changed directions as of 2021, seemingly hitting the peak of the mountain. Click the below image to watch the full video, or click the gold button to boom your Free DB Consultation.

In 2022, as a result of excessive inflation, the Central bank has had to try and put the stoppers on by increasing the base rate. This in turn has decreased gilt prices and meant newly issued gilts will have higher coupon rates, this has resulted in a shift in momentum with CETVs now falling. As interest rates are expected to continue to rise with the expectation of 3% by the end of the year, this has even greater impact on CETVs as it is not just the current rate, it is also the expected future rate that impacts CETVs. The higher the rate and a higher the expectation, the more CETVs will fall. Despite, inflation rising above last year’s level, the increase in interest rates is a bigger factor in calculations than of inflation.

Why is now the best time to complete a DB transfer? Now it might seem logical to wait to transfer until rates fall again, so your CETV can go up, but this is likely a big mistake. Interest rates are unlikely to fall again for at least 2 years, if not longer, and are usually lowered during recessionary periods to simulate economic activity. In fact, interest rates are expected to continue to rise over the next year or two. Therefore, you risk greater fall in CETVs if you fail to move now. Additionally, to wait to the next recession for lower CETVs is also a mistake given the unpredictability of the DB market, it could be the case in the near future that you can no longer transfer out, as regulation continues to tighten in this area. If this is the case, then you could entirely lose the option to move to a SIPP or DC scheme.

World Growth

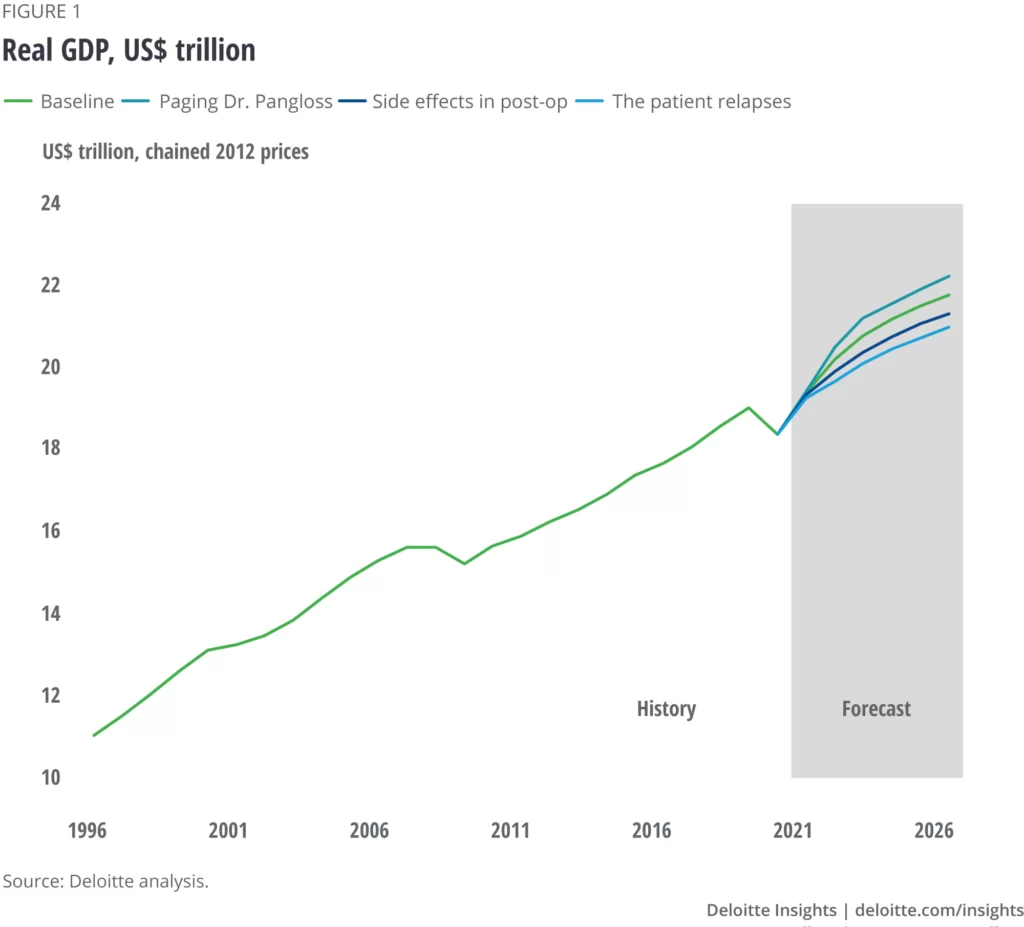

According to the World Bank’s latest Global Economic Prospects Report released in June, Global Growth is expected to fall from 5.7% in 2021 to 2.9% in 2022, a significant fall and a downwards adjustment from their projection of 4.1% in January 2022. They expect GDP to remain around this level until 2023-2024, and unfortunately, the countries hit hardest seem to be developing countries whose level per capita income will be almost 5 percent below pre-pandemic trends.

In advanced economies, growth is expected to slow from 5.1 percent in 2021 to 2.6 percent in 2022, a 1.2 percent drop from January’s expectations.

Among emerging and developing economies. Growth is expected to decrease from 6.6 percent in 2021 to just 3.4 percent in 2022, a significant dip below the average 3.4 percent of 2011-2019.

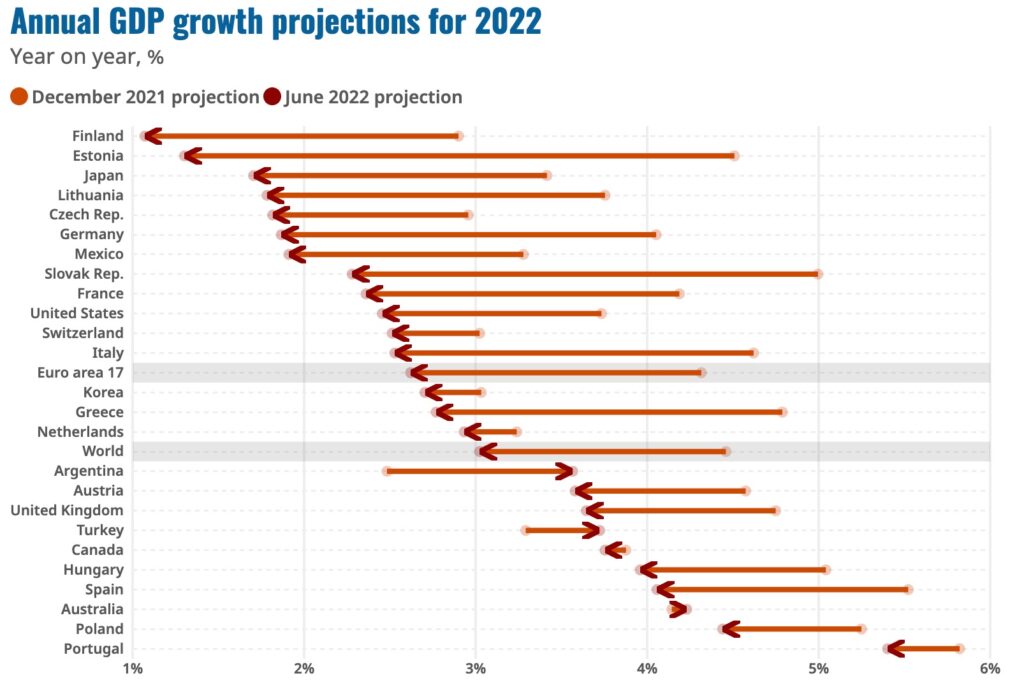

The OECD also has similar projections in for 2022, and by the graph presented below you can see the significant fallback in projected GDP since January for most countries.

Humanitarian Impact

Russia’s invasion of Ukraine casts a wider net, causing hardship that risks famine in parts of the globe. Russia and Ukraine together supply approximately 30% of global wheat exports, 20% of corn, mineral fertilizer, and natural gas, and 11% of oil. Prices of these commodities rose significantly since the start of the war

There is a potential food crisis looming. Supply disruptions, threaten low-income countries, that are dependent on Ukraine and Russia for key food imports. After already a tough few years of government spending during the pandemic, these countries could struggle to provide food and energy for their citizens, risking famine and social unrest.

Global Response to Inflationary Pressures

Central banks aware of the spiralling inflation have had a similar response in tackling inflationary pressures. Firstly, policy rates have been increased and are expected to increase over the next one to two years for major economies. Secondly, to a smaller extent, some central banks have used open market operations to sell assets typically government bonds to reduce banks’ reserves to increase bank interest rates (link).

Bitcoin Plunges Below $19,000

Cryptocurrencies have seen great turmoil over the last few months, with many digital currencies seeing their share prices slump. BTC, the key cryptocurrency, has since its share price fallen to under $19,000 in June, a level not seen since December 2020.

Signs of disarray erupted in May with the collapse of Terra, an algorithmic stablecoin blocked which was pegged to fiat currencies like the dollar, which are intended to hold their value against the peg. Unfortunately for cryptocurrencies, if one goes down it can have a sufficiently negative impact on another even though seemingly their failings have no connection, but can have a shift in market sentiment.

The drop below $20,000 is seen as an important threshold, as this is where many investors fear a liquidation from largely leveraged hedge funds and other institutions. It will be interesting to see where the currency goes from here, whether we see a huge sell-off of the currency or possible recovery.

There are multiple reasons why Bitcoin and other cryptos have been hit hard recently. Inflation has taken its toll, prompting interest rate hikes, therefore, weakening investor confidence and risk-taking in financial markets, and out of the more volatile stocks crypto has been deeply affected.

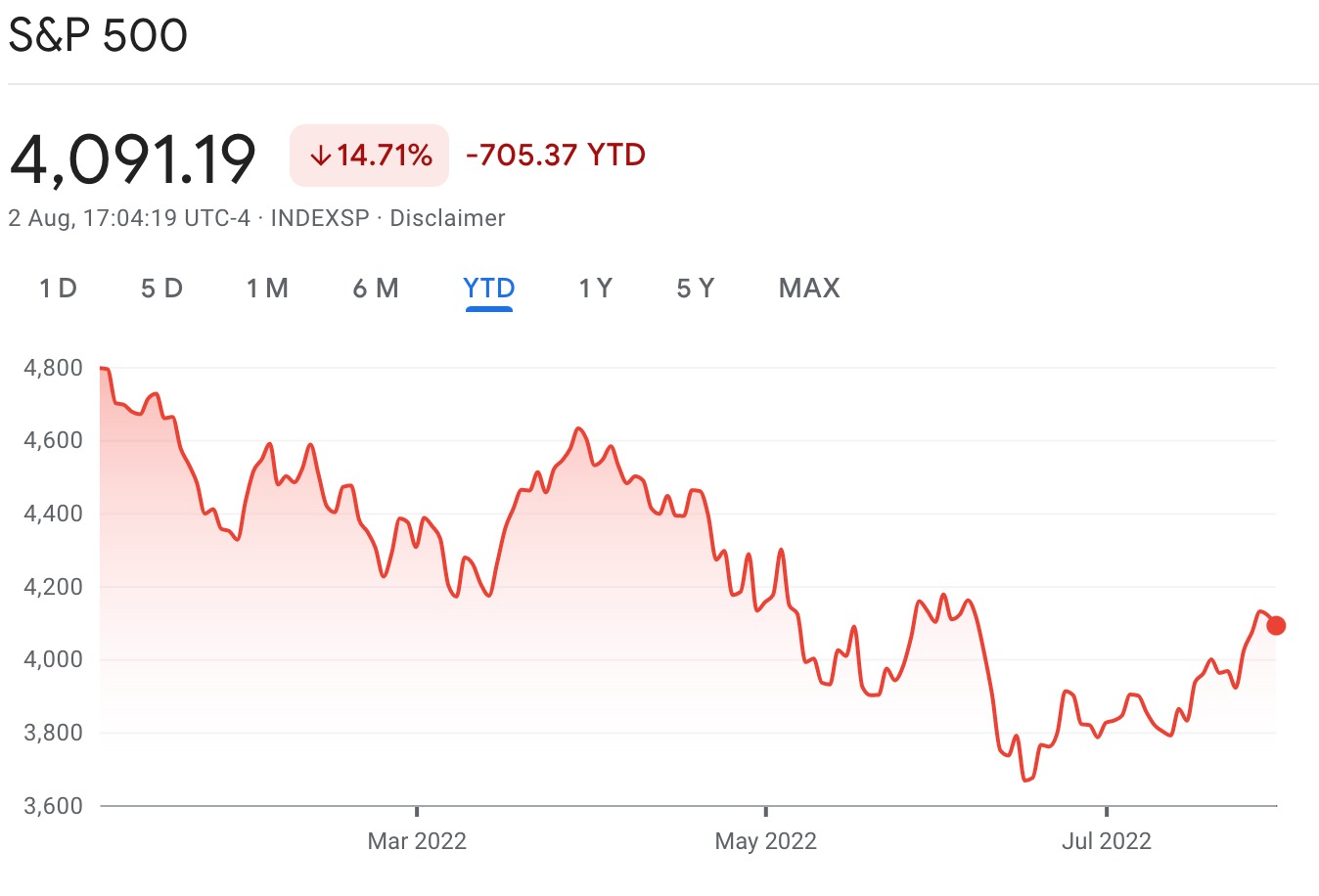

It also continues on the trend that Cryptocurrencies have correlated with the performance of the economy and in general, the S&P500, which has fallen by 20% since its peak in January. One of the main supposed advantages of Bitcoin was that it was a hedge against the markets, similar to gold. However, that idea has now been firmly removed.

Markets & Interest Rates

It has been a turbulent quarter for markets following a sudden change in monetary policy. Markets were expected a much slower transition to higher interest rates and unsurprisingly had not priced in the need to accelerate that timeline mainly as a result of inflationary pressures from the war in Ukraine. Central banks had been holding off on hikes during inflationary pressures at the beginning of this year to help promote economic growth and avoid market shocks, but the focus now is clearly prioritizing price stability.

History often repeats itself and after monetary contraction, we often see a recessionary period, even if this is a soft recession where we see only two consecutive periods of GDP contraction. According to Janus Henderson, with core inflation at its current level, 80% of tightening cycles in G10 economies were followed by recessions.

Global equities have now fallen more than 20% from January’s peak, there is some rest of mind in that stocks valuations were unusually elevated, particularly among US growth stocks.

S&P 500

The S&P 500 is down 20% over the last since months since its peak in January. The market is undecided on whether there will be a recession later in the year, if inflation can be curbed by the end of the year then there’s a good chance the market prices will recover. Despite, prices falling, earnings are estimated to grow by 9.3% in 2022 year-on-year, which is actually an increase from April’s estimate of 8.8% according to IBES data.

Growth Stocks

At Cameron James, we have tended to favour tech and other growth stocks; and they now seem relatively cheap. Scottish Mortgage is down 44.18% over the last year. One of the previously most hyped growth stocks, Netflix has had a terrible period, down 65.92% over the last year and announced a lay-off of 300 employees in response to a first-time decrease in subscriptions in Q1 of 2022.

We also see that Amazon and Tesla are both down around 40 percent YoY. According to the Scottish Mortgage investment manager, it has been the worst start for growth stocks in 90 years. With the movement away from low-interest rates, investors are less willing to wait for returns on growth stocks. Using traditional valuation models, the discounting becomes more significant with higher interest rates, and hence with cash flows further down the line, a growth stock is valued less.

Those that are suffering the most are those with the highest P/E values, not all growth stocks are falling so significantly. This does, however, present an opportunity for value stocks, who now may have a bigger role to play in portfolios, so far, this year Value stocks have dominated in terms of performance. Investors feeling defensive are favouring cash flows now with consistent dividends.

Government Bonds

Government bonds have rallied in response to the real possibility of the US heading towards a recession. Often when market sentiment is poor, people tend to buy more government bonds, particularly US bonds, as these are seen as having zero risk. As a result, government bond yields have fallen as fixed coupons fall as a percentage of the asset price. The yield on 10-year Treasury notes is now 3.118%, the two-year treasury yield is 3.046% and finally, the 30% treasury yield is 3.219% as of June 24th.

Government bonds have been fairly volatile as well over the first half of 2022, initially, yields were rising in response to interest rate hikes, but as fears of recession loom bonds are again being repurchased by investors as a safe haven asset.

However, the idea that all bond funds are safe havens has also disappeared. With some headline UK bond funds now down 13% over the past 12-months. Imagine investing in a safe asset and being 13% down, you may as well be invested in equities and benefit from the rally that will come.

US Growth

According to the OECD, GDP is anticipated to slow down from the booming recovery of 2021 to 2.5% in 2021 and 1.2% in 2023. We have seen over the first quarter of 2022 a contraction in Real GDP (this calculates nominal growth relative to the increase in prices). Resulting from hawkish monetary policy, government debt reduction, supply disruptions, and rising oil prices. The supply side pressures come from the War in Ukraine and also zero policy COVID in China and will take some time to elevate.

Moreover, we expect to see some pullback in demand as pandemic-related fiscal stimulus support will expire, causing a reduction in spending by households, although the multiplier effect of the flow of money between households and firms may have some lasting impact.

US Inflation

As with other major countries, the US is facing high levels of inflation and a substantial increase in living costs. In Q2, the FED made the largest increase in interest rates for the last 30 years, on June 16th moving the interest rate up from 1% to 1.75%. It is forecasted that interest rates could reach 3-3.25% by the end of 2023, in order to meet the FED’s objective of full employment and price stability.

UK GDP Growth

The UK economy expanded its GDP by 0.8% in Q1 2022, a slowing from a 1.3% expansion in Q4 and below market expectations of 1%, initial indicators present. GDP is now 0.7% above its pre-pandemic levels. However, a slowdown is expected over the coming months, largely due to inflationary pressures curbing demand and the following interest rate hikes contracting the economy. The economy already contracted 0.1% in March, and according to the BoE will stay relatively unchanged in Q2,Q3 but contract around 1% in Q3.

UK Employment

Employment indicators have largely been positive over the last quarter, according to ONS figures. The latest for UK employment was a 0.1 percentage point increase in May over the previous three months. The unemployment rate was estimated at 3.7% in May, 0.3 percentage points lower than the previous three months and 0.2% below coronavirus pandemic levels (ONS).

UK Inflation

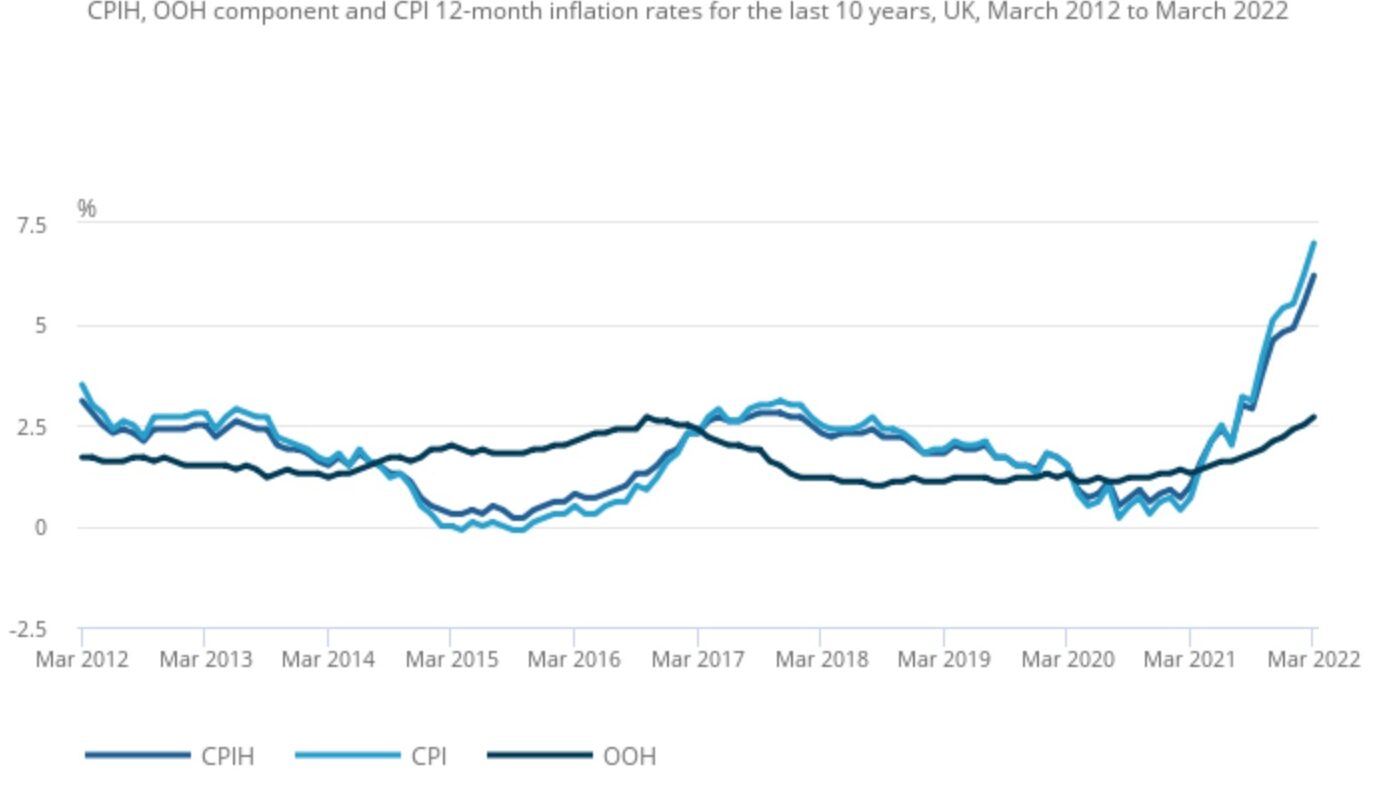

Twelve-month CPI inflation rose to 7.0% in March, around 1 percentage point higher than expected in the February report. In the BoE’s May Report central projection, CPI is set to rise further to just over 9% in 2022 Q2 and peak it Q4 at just over 10%. The increase in prices reflects the higher household energy prices, which came after the rise in Ofgem price cap in April and likely increases in October. The idea of the price cap mechanism is for it to take some time for wholesale gas and electric prices to rise.

UK Monetary Policy

In response to the continuation of inflationary pressures, the Bank of England has made a series of interest rates hikes over Q2. In May and June, the BoE increased the Bank Rate by two 0.25% increments. The current bank rate is 1.25% and the next review by the Monetary policy committee will be on the 4th August 2022. It is more than likely we could see another 0.25% increase at the next committee meeting, with the expectation to reach 2% Bank Rate by the end of 2022 with projections to reach 2.5% by mid-2023.

The main goal of the committee is to maintain the 2% long-term inflation target, which in turn helps maintain long-term growth and employment. With the following set of measures they expect inflation to be just above 2% in 2 years time and in 3 years time below the 2% target.

The BoE is now considering beginning the process of selling UK government bonds held in the Asset Purchase facility, similarly to increasing the bank rate, this will increase interest rates by reducing the reserves of banks increasing the LIBOR rate. They, however, are undecided based on economic conditions in the following months, not wanting to destabilise financial markets, a decision on which will be made in the upcoming August meeting (Bank of England).

Most Watched YouTube Videos

We are proud that our new and existing clients continue to educate themselves on complex DB and DC topics via our YouTube channel. The team has worked tirelessly on the channel over the past three months, and we are very happy with the results.

Covering important resources such as #1 DB Guide Transfer Suitability and growing problems like the possible Banning of the DB Pension Transfers.

Complete your homework and due diligence, before reaching out to Cameron James for your Free Initial Appointment with myself or one of our advisors. We will be continuing to invest our time and energy in the channel, and it is one of the best places to have updates from the company.

If you have not done so already, be sure to subscribe to the channel for our latest news and updates.

Cameron James Updates Retain Clients in the UK

We are pleased to announce that, on a case-by-case basis, we can now offer the opportunity for UK clients to move forward with their Defined Benefit pension transfer against official PTS advice. Some clients wish to move forward with their pension transfer even after receiving official advice report to retain their UK DB scheme. Although, this is an important decision, and requires an extra round of due diligence and checks to ensure clients fully understand their actions. Please get in touch with an adviser today if you wish to discuss your DB Pensions and the possibility of transferring them.

Welcoming our newest IFA: Andere Casanova

Andere joins Cameron James with a wealth of financial experience as a CFA III candidate. Her professional experience also includes positions at the Central Bank of Spain, CFO in South Africa and as a Senior Consultant in Dubai. As a Spanish national who also speaks German and French, she will be bringing a new international edge to Cameron James.

Andre has already passed her first IFA exam in record time and has her next exams scheduled. We think Andere has both the technical ability and long-term view to be an excellent Financial Adviser with a very successful career. Welcome to the team, Andere!

Continued Stable Growth

The company continues to expand with stable growth, taking on new positions this quarter in both the Administration department and the Digital Marketing Team. We are also pleased to confirm, that whatever the economy might have and hold in the coming quarters, Cameron James will continue to grow steadily and not expand too fast. Unlike many household name companies, who are currently laying off large swathes of their staff.

Closing Remarks

My goal, at Cameron James, has never been to become the largest IFA firm in the world. While this might be a very profitable goal, it invariably leads to a lessening of the quality of advice. As it is almost impossible to maintain the same strict structures and procedures that create quality advice.

From a company perspective, we remain resilient and strong. Reinvesting heavily in the companies resources, staff, and technology, to continue delivering a high level of ongoing service.

Should you ever wish to speak with me directly, please do just drop me an email and I will be happy to chat or even schedule a call.

Take care and speak soon!

Dominic James Murray

CEO & Founder

Cameron James